Featured

- Get link

- X

- Other Apps

Average Settlement Period For Payables

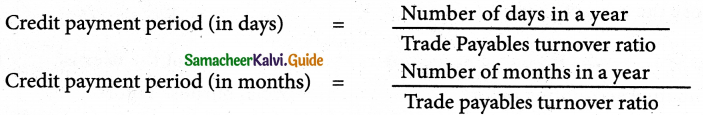

Average Settlement Period For Payables. Web in contrast, the average settlement period for payables shows a marginal rise. Creditor days estimates the average time it takes a business to settle its debts with trade suppliers.

Web the creditor (or payables) days number is a similar ratio to debtor days and it gives an insight into whether a business is taking full advantage of trade credit available to it. Means, in the case of each relevant member of the group, the amounts payable to an end user, card scheme, merchant, cardholder of a card scheme, bank, financial institution or other similar entities or persons under settlement contracts in respect of transactions which have been notified to the relevant member of the group. Web in contrast, the average settlement period for payables shows a marginal rise.

You Do That By Dividing The Sum Of Beginning And Ending Accounts Payable By Two, As You Can See In This Equation.

You can view the cl. Web average payable balance= (beginning balance + ending balance) / 2. So, the average payment period the company has been operating on is 84 days.

Next, This Is Plugged Into The Average Payment Period Equation As So:

I'm studying for part 2 of my credit management exam, and revising the ratios but i'm a bit confused. First of all, you have to establish the average accounts payable. What is the length of the cash conversion cycle?

You Might Also Divide Cost Of Sales Or Cost Of Goods Sold (Cogs) Rather Than Total Supplier Purchases (Net Credit Purchases) By The Average Accounts Payable Value, Depending On Your Company’s Bookkeeping Methods.

Accounts receivable payment period = average receivables / (net credit sales / 365 days) net credit sales =1,000,000 usd. Web the formula to figure this is ($200,000 + $205,000) / 2, so the average accounts payable is $202,500. In other words, this ratio is a measure of average credit period allowed by the suppliers.

Means, In The Case Of Each Relevant Member Of The Group, The Amounts Payable To An End User, Card Scheme, Merchant, Cardholder Of A Card Scheme, Bank, Financial Institution Or Other Similar Entities Or Persons Under Settlement Contracts In Respect Of Transactions Which Have Been Notified To The Relevant Member Of The Group.

Accounts receivable payment period = 22,500 / (1,000,000 / 356) = 8 days. Based on the starting point of the cash outflows, cash conversion cycle is calculated with the accounts payable period as a subtraction from the total operating cycle. For our example, the average collection period calculation looks like the one below:

Company A Reported Annual Purchases On Credit Of $123,555 And Returns Of $10,000 During The Year Ended December 31, 2017.

Web assumed, the subject company of this business report is located in the uk, the average settlement periods for trade receivables and payables are far above the average. Increasing accounts payable turnover ratio Trade payables days, also known as “days payables outstanding (dpo)” and “average time to pay”, is a financial ratio showing the average time to pay cash to a supplier after making credit purchase.

Popular Posts

What Is The Average Length Of A Caterpillar

- Get link

- X

- Other Apps

Comments

Post a Comment